Deferred Retirement Annuity

Annuities and the fixed indexed annuity are a financial vehicle which are used every day by corporations and government agencies to

maximize, guarantee, and insure streams of income to their respective beneficiaries. When an individual wins the lottery, the best fixed rate annuities are purchased with them as the beneficiary to guarantee the payments over a period of time, usually 20 years. The a fixed rate annuity is purchased at a much lower face amount than the prize. This is why winners get the option of 50% of the prize now, or 100% over a fixed period of time.When an individual retires from a job, their pension is determined by how much has been vested in their pension fund. This amount is then used to purchase a fixed indexed annuity with the retiree as the beneficiary, in order to guarantee a fixed monthly payment for life.

Over the past decade, annuities have evolved into investment instruments which could be used by everyday individuals, to guarantee financial stability and above-average returns. Most financial consultants will not recommend annuities to their clients, because there are no management fees, no cost at all to the purchaser, and no constant stream of commissions to be generated.

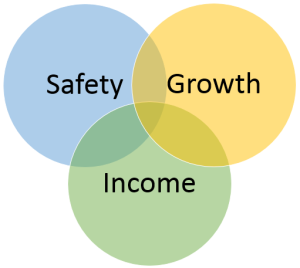

There are two categories of annuities, fixed and variable. We only recommend fixed annuities to our clients, because there is no chance of loss … ever! Within the category of fixed annuities, there are two types to choose from, depending on the client’s specific needs and long term plans.

The first is a fixed rate annuity. This annuity guarantees a fixed minimum rate for the entire annuity period. This means that you are guaranteed a minimum rate for the first year. Every year on the anniversary, that rate can either increase for the next year or stay the same. If rates increase during that year, you participate and get the higher rate. If rates decrease, you keep the minimum rate for the next year. Under no situation can your rate drop below the minimum guaranteed rate.

The second type of annuity is the equity indexed fixed annuity. The returns in this type of annuity are based on the S&P 500. It works as follows: you receive a bonus on the first day you fund your annuity (13% in 11/2009). This means that if you invest $100,000, your starting balance will be $113,000. From here, your returns are based on the S&P 500 returns. If the market goes up from day 1 to the one year anniversary, you participate in the returns. However, if the S&P 500 goes down, you lose nothing. In addition, you capture your gains on your annual anniversary date every year. This means that if your account goes up by 7% the first year, and in the second year it goes down 7%, your starting balance after the second year will still be 7% higher. On years the market goes down, your balance simply stays the same with no increase. With this type of annuity, there is also no chance of loss.

The following are benefits and definitions of features common to both of the above annuities:

Tax differed growth: Unlike regular stock accounts or CD’s, you do not get a 1099 at the end of the year for your gains. There are no taxes due on the money unless you take it out. This allows your funds to compound at a quicker rate. In addition, this gives you a higher effective interest rate. If you make 3% in your CD, and are in a 30% tax bracket, your real interest rate is 2.1% after taxes. There is no chance of loss: depending on which type you choose, the worst case scenario is that your balance stays the same over the year. It can never decrease, regardless of market conditions.

Tax-free inheritance: Annuities have beneficiaries attached to them. At time of your death, your beneficiary receives the full account balance free of federal taxes, free of probate. If you have money in a regular IRA and pass away, your beneficiary will have to pay taxes on that money according to their tax bracket. In a regular IRA, if you have $100,000 and pass away, your beneficiary will get $70,000 maximum after taxes. With an annuity, he or she would get the full $100,000.

Easy Access: You may take out 10% plus interest or gains every year penalty free. Also, if you do not take the 10% one year, next year you can take 20% penalty free.

Life Income Riders: This guarantees you a certain amount of income every month, based on your account value. The income is guaranteed, even if you outlive the original principal balance when you elect this option. It also offers an option where if you die, your spouse keeps receiving the payments. This is how retiree pensions are structured. This is an important tool to help people subsidize their income in retirement. Guarantee: your money is guaranteed by the state. Each state has different guidelines on amounts. In these turbulent times, it is important to know your investment is safe.

Annuities do contain surrender charges for periods ranging between 5 and 15 years, depending on which specific annuity you choose. Surrender charges do not apply to yearly 10% withdrawals or at time of death. Therefore, we never recommend a client to invest all of their funds in annuities. They are used most effectively and efficiently for retirement assets.Annuities are considered qualified accounts. This means that you can roll your IRA or 401K into one with no tax liabilities. This is money you will not be using for some time, and more importantly, money which you want to guarantee will be there when you retire and need it most.

Millions of Americans were forced to keep working after the market crash of 2008. Had that money been invested in annuities, they would have lost nothing, and would have been able to accomplish their dreams for which they worked their entire lives.