Accident Plans Accident Brochure

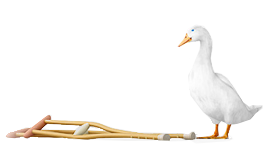

Nobody plans to be in an accident, but when it happens, medical bills can start adding up fast. Aflac’s accident insurance plans help employees be prepared by providing benefits for many costs associated with accidental injury.

Individual Products

- Accident Indemnity Advantage – series A35000

At-a-glance

Accidents are not planned and can happen at any moment. But when it happens, medical bills can start adding up fast. Help your customers be prepared: Aflac Accident Indemnity Advantage insurance policies pays cash benefits to help provide peace of mind during the different stages of care and recovery. Benefits can be used to help pay for emergency treatment, broken bones, lacerations, concussions, broken teeth, and ambulance transportation, as well as for treatment-related transportation and lodging.

In addition, the Aflac Plus Rider can be added to new or existing Accident Indemnity Advantage plans.

Key Features

- Two coverage options available: 24-hour coverage or off-the-job only

- Three plan levels

- Benefits for many major/minor procedures and common injuries

- Coverage for certain hazardous activities

- Additional Accidental-Death Benefit Rider available

- Optional disability benefit riders available

- Aflac Accident Advantage – A36000

At-a-glance

Aflac Accident Advantage insurance policy helps with the unexpected out-of-pocket costs that can hurt the family budget when accidents happen – like ER visits and hospitalization. In addition, the plan offers multiple coverage options to accommodate almost any budget, and provides new and enhanced benefits not previously available with Aflac accident insurance.

Key Features

- More flexibility with four options of coverage for injuries such as fractures, dislocations, lacerations, concussions, burns, emergency dental work, eye injuries and surgical procedures.

- An enhanced Accident Treatment Benefit that includes different levels of benefits according to whether or not x-rays are ordered during an emergency room visit or at another location such as a doctor’s office. Plus, coverage has expanded for care not only from a doctor, but a physician’s assistant or nurse as well.

- No waiting period for the Wellness Benefit, and it pays every calendar year for covered persons (once per policy, per calendar year).

- An Organized Sporting Activity Benefit with an additional benefit payout for injuries sustained while playing an organized sport.

- An enhanced Appliance Benefit on all coverage options that provides a cash payout for crutches, wheelchairs, braces and other eligible items that aid in personal locomotion.

- New Home Modification, Waiver of Premium and Family Support Benefits.

- Enhanced physical, speech and occupational therapy benefits.

- A new Prosthesis Repair or Replacement Benefit

- Personal Accident Indemnity A-34000

At-a-glance

Accidents are not planned and can happen at any moment. But when it happens, medical bills can start adding up fast. Help your customers be prepared: Aflac Personal Accident Indemnity insurance policies pays cash benefits to help provide peace of mind during the different stages of care and recovery. Benefits can be used to help pay for emergency treatment, broken bones, lacerations, concussions, broken teeth, and ambulance transportation, as well as for treatment-related transportation and lodging.

Key Features

- Two coverage options available: 24-hour coverage or off-the-job only

- Two plan levels

- Benefits for many major/minor procedures and common injuries

- Optional disability benefit riders available

Group Products

- BenExtendConsumerism is fundamentally changing benefits delivery and usage. Yet demands for protection, quality and value persist. BenExtend is designed to meet varying employee needs while supporting client plan redesign strategies in today’s changing benefits landscape.This first-to-market solution provides options that helps remove the guesswork from benefits plan design for both your clients and their employees. With employer-paid and voluntary coverage options, you can offer a solution that aligns with any holistic benefits strategy. And, for even greater levels of financial protection, employers can offer their employees additional standalone Aflac group hospital indemnity (Employer-Paid Option Only), accident and/or critical illness coverages on a voluntary basis. For employees, this simplified approach offers them a broader range of coverage for the most common illnesses and injuries.

- Group Accident 70000

At-a-glance

Nobody plans to be in an accident. But when it happens, Aflac group accident insurance pays certificateholders directly (unless otherwise assigned).

The plan pays benefits that can be used toward medical expenses that major medical was never intended to cover—or for everyday bills, like rent or mortgage, utilities and groceries—to help certificateholders stay-up-to-speed while recovering from an accident, regardless of an existing employer-sponsored health care benefit.

- Group Accident Advantage Plus

At-a-glance

Nobody plans to be in an accident. But when it happens, Aflac group accident insurance pays certificateholders directly (unless otherwise assigned).

The plan pays benefits that can be used toward medical expenses that major medical was never intended to cover—or for everyday bills, like rent or mortgage, utilities and groceries—to help certificateholders stay-up-to-speed while recovering from an accident, regardless of an existing employer-sponsored health care benefit.